Burma - AgricultureBurma - Agriculture

Overview

The agriculture sector is one of the most important sectors for the country's economy; agricultural goods are Myanmar’s second largest export commodity. The agriculture sector contributes 38 percent of GDP, accounts for 20 to 30 percent of total export earnings and employs more than 70 percent of the workforce. 12.8 million hectares out of 67.6 million hectares of land in Myanmar are cultivated land. Rice is the country's primary agricultural product, which accounts for nearly 43 percent of the total agricultural production value. In Myanmar, 70 percent of the country’s population live in rural areas and their livelihood drives the agriculture sector as an important growth engine of rural development. In July 2016, the Government of Myanmar officially announced a 12-point economic plan targeted at developing a market-oriented economy. The government focuses on strengthening farming production, enhancing food security, increasing exports and improving living standards of the rural population, which depends on farming as their first and key source of income.

According to the United States Department of Agriculture (USDA) Grain and Feed Report of 2019, production of rice and corn in Myanmar is forecast to increase in Fiscal Year (FY) 2019-20 due to expansion of planting areas. Myanmar’s overall rice exports are expected to be stable as decreasing exports to the European Union balance out increasing exports to China. Rice production in FY 2019-20 is forecast to increase as farmers increase planting acreage in anticipation of favorable weather and due to attractive prices. Myanmar’s overall rice exports in FY 2019-20 are forecast remain at the same level as FY 2018-19 at 3.0 MMT. There will be some lost market potential in the EU, offset by some increased market potential in China.

Myanmar’s corn exports in FY 2018-19 and FY 2019-20 are likely to expand in line with continued demand from China. Corn production is expected to reach 2.3 MMT in FY 2019-20 and the domestic corn demand in FY 2018-19 and in FY 2019-20 is expected to increase due to the growth in the livestock sector. Overall Myanmar’s corn exports in FY 2018-19 and FY 2019-20 are expected to remain at 1.4 million metric tons.

Myanmar’s wheat import demand and consumption is likely to increase in FY 2019-20 in anticipation of renewed demand for snacks, noodles and baked goods derived from wheat flour. Wheat production is estimated to decrease in FY 2019-20 as domestic demand is met with imports. Wheat imports are expected to increase 13 percent in FY 2017-18 as a result of changing consumer preferences and resulting higher domestic demand.

Myanmar’s top agricultural exports include rice, maize, black gram, green gram, pigeon pea, chick pea, sesame, onion, tamarind, raw rubber, vegetables, and fruits. Myanmar’s major import items in the agricultural sector are power tillers, hand tractors, fertilizers, pesticides, herbicides, diesel oil, dumpers, loaders and spare parts, water pumps, hydraulic excavators, gear box assembly for hand tractors, MS rod & mild steel, hybrid and quality seeds.

Myanmar does not yet have laws or regulations pertaining to Genetically Modified Organism (GMO) crops or seeds, which are currently imported without any restrictions.

Leading Sub-Sectors

Agricultural Machinery and Equipment: Myanmar could position itself in the global supply chain market by moving up the production value chain and making finished goods with the help of advanced machinery and equipment. Currently, Myanmar depends on traditional manual labor and lacks the advanced technology needed to produce value-added finished goods. Developing agro-based industry is one of the top priorities for both the government and domestic members of the private sector. The Government of Myanmar has consistently encouraged farm enterprises to move beyond exporting raw agricultural products and produce high quality finished goods with the help of refineries, packaging facilities and advanced mills.

There is market potential for U.S. manufacturers of agricultural equipment and farm machinery. Machinery used in the assembly and manufacturing of light to heavy agricultural machinery, power tillers, walking tractors, water pumps, sprinklers, drip irrigation sets, transplanters, threshers, seeders, weeders, dryers and farm storage facilities are all in high demand.

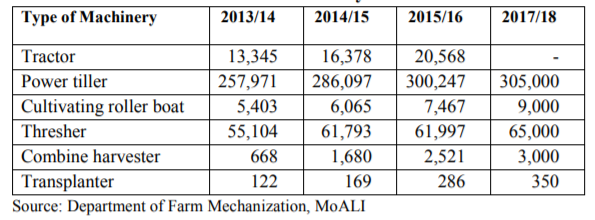

Utilization of Farm Machinery in Myanmar

Fertilizer: Myanmar has a very competitive fertilizer market compare to other ASEAN countries and the fertilizer industry is attracting a growing number of foreign investors. Fertilizer is one of the most imported items in this sector; Myanmar imports about 80 percent of chemical fertilizers from China and Thailand, estimated at between 1.2 and 1.4 million tons per annum. Myanmar produces domestically 15 percent of fertilizers and does not have a competitive advantage in fertilizer production at this time despite having natural gas as a resource for ammonia production.

Organic farming is strongly encouraged by the Government of Myanmar. However, due to the slow results of organic fertilizers, local farmers prefer chemical fertilizers, which offer quicker results and more opportunities to harvest.

American fertilizer companies can find opportunities to export to Myanmar as the demand for high quality fertilizer continues to rise. The Government of Myanmar has set targets for higher agricultural output and domestic dealers are constantly looking for higher quality fertilizer options than those currently being used and available in the market.

Other sub-sectors with excellent prospects for investment opportunities are chemicals production, transport, storage, wholesale, processing, and agricultural services, contract farming, irrigation system and facilities, farm industry, research and development, value-added production, packaging industry for local agricultural produce, warehouses and cold storages facilities, service support for supply chain, microfinance and trade finance services for local farmers.

Opportunities

Foreign investment in the agriculture sector is only 0.5 percent of total FDI, so there are huge investment opportunities available for the U.S. investors. The GOM encourages both local and foreign investors to consider investing in either a joint venture or a 100 percent investment in areas such as agro-based industries, assembling and manufacturing light agricultural machinery and small farm implements, manufacturing agricultural inputs and related support products. According to the Ministry of Commerce Notification No. 96/2015 dated November 11, 2015, foreigners can trade in products such as fertilizers, insemination seeds and pesticides as joint ventures with Myanmar citizens with no minimum share percentage for the local citizens.

Web Resources

International Fertilizer Development Center (IFDC)

International Rice Research Institute (IRRI) Myanmar Pulses, Beans & Sesame Seeds Merchants Association

Myanmar Edible Oil Dealers Association

Myanmar Fruit, Flower and Vegetable Producer and Exporter Association

Myanmar Rice Federation

Contact Information

U.S. Commercial Service Myanmar

Ms. Ummay Aiman

Commercial Specialist

Email: Ummay.Aiman@trade.gov

Prepared by our U.S. Embassies abroad. With its network of 108 offices across the United States and in more than 75 countries, the U.S. Commercial Service of the U.S. Department of Commerce utilizes its global presence and international marketing expertise to help U.S. companies sell their products and services worldwide. Locate the U.S. Commercial Service trade specialist in the U.S. nearest you by visiting http://export.gov/usoffices.

The agriculture sector is one of the most important sectors for the country's economy; agricultural goods are Myanmar’s second largest export commodity. The agriculture sector contributes 38 percent of GDP, accounts for 20 to 30 percent of total export earnings and employs more than 70 percent of the workforce. 12.8 million hectares out of 67.6 million hectares of land in Myanmar are cultivated land. Rice is the country's primary agricultural product, which accounts for nearly 43 percent of the total agricultural production value. In Myanmar, 70 percent of the country’s population live in rural areas and their livelihood drives the agriculture sector as an important growth engine of rural development. In July 2016, the Government of Myanmar officially announced a 12-point economic plan targeted at developing a market-oriented economy. The government focuses on strengthening farming production, enhancing food security, increasing exports and improving living standards of the rural population, which depends on farming as their first and key source of income.

According to the United States Department of Agriculture (USDA) Grain and Feed Report of 2019, production of rice and corn in Myanmar is forecast to increase in Fiscal Year (FY) 2019-20 due to expansion of planting areas. Myanmar’s overall rice exports are expected to be stable as decreasing exports to the European Union balance out increasing exports to China. Rice production in FY 2019-20 is forecast to increase as farmers increase planting acreage in anticipation of favorable weather and due to attractive prices. Myanmar’s overall rice exports in FY 2019-20 are forecast remain at the same level as FY 2018-19 at 3.0 MMT. There will be some lost market potential in the EU, offset by some increased market potential in China.

Myanmar’s corn exports in FY 2018-19 and FY 2019-20 are likely to expand in line with continued demand from China. Corn production is expected to reach 2.3 MMT in FY 2019-20 and the domestic corn demand in FY 2018-19 and in FY 2019-20 is expected to increase due to the growth in the livestock sector. Overall Myanmar’s corn exports in FY 2018-19 and FY 2019-20 are expected to remain at 1.4 million metric tons.

Myanmar’s wheat import demand and consumption is likely to increase in FY 2019-20 in anticipation of renewed demand for snacks, noodles and baked goods derived from wheat flour. Wheat production is estimated to decrease in FY 2019-20 as domestic demand is met with imports. Wheat imports are expected to increase 13 percent in FY 2017-18 as a result of changing consumer preferences and resulting higher domestic demand.

Myanmar’s top agricultural exports include rice, maize, black gram, green gram, pigeon pea, chick pea, sesame, onion, tamarind, raw rubber, vegetables, and fruits. Myanmar’s major import items in the agricultural sector are power tillers, hand tractors, fertilizers, pesticides, herbicides, diesel oil, dumpers, loaders and spare parts, water pumps, hydraulic excavators, gear box assembly for hand tractors, MS rod & mild steel, hybrid and quality seeds.

Myanmar does not yet have laws or regulations pertaining to Genetically Modified Organism (GMO) crops or seeds, which are currently imported without any restrictions.

Leading Sub-Sectors

Agricultural Machinery and Equipment: Myanmar could position itself in the global supply chain market by moving up the production value chain and making finished goods with the help of advanced machinery and equipment. Currently, Myanmar depends on traditional manual labor and lacks the advanced technology needed to produce value-added finished goods. Developing agro-based industry is one of the top priorities for both the government and domestic members of the private sector. The Government of Myanmar has consistently encouraged farm enterprises to move beyond exporting raw agricultural products and produce high quality finished goods with the help of refineries, packaging facilities and advanced mills.

There is market potential for U.S. manufacturers of agricultural equipment and farm machinery. Machinery used in the assembly and manufacturing of light to heavy agricultural machinery, power tillers, walking tractors, water pumps, sprinklers, drip irrigation sets, transplanters, threshers, seeders, weeders, dryers and farm storage facilities are all in high demand.

Utilization of Farm Machinery in Myanmar

Fertilizer: Myanmar has a very competitive fertilizer market compare to other ASEAN countries and the fertilizer industry is attracting a growing number of foreign investors. Fertilizer is one of the most imported items in this sector; Myanmar imports about 80 percent of chemical fertilizers from China and Thailand, estimated at between 1.2 and 1.4 million tons per annum. Myanmar produces domestically 15 percent of fertilizers and does not have a competitive advantage in fertilizer production at this time despite having natural gas as a resource for ammonia production.

Organic farming is strongly encouraged by the Government of Myanmar. However, due to the slow results of organic fertilizers, local farmers prefer chemical fertilizers, which offer quicker results and more opportunities to harvest.

American fertilizer companies can find opportunities to export to Myanmar as the demand for high quality fertilizer continues to rise. The Government of Myanmar has set targets for higher agricultural output and domestic dealers are constantly looking for higher quality fertilizer options than those currently being used and available in the market.

Other sub-sectors with excellent prospects for investment opportunities are chemicals production, transport, storage, wholesale, processing, and agricultural services, contract farming, irrigation system and facilities, farm industry, research and development, value-added production, packaging industry for local agricultural produce, warehouses and cold storages facilities, service support for supply chain, microfinance and trade finance services for local farmers.

Opportunities

Foreign investment in the agriculture sector is only 0.5 percent of total FDI, so there are huge investment opportunities available for the U.S. investors. The GOM encourages both local and foreign investors to consider investing in either a joint venture or a 100 percent investment in areas such as agro-based industries, assembling and manufacturing light agricultural machinery and small farm implements, manufacturing agricultural inputs and related support products. According to the Ministry of Commerce Notification No. 96/2015 dated November 11, 2015, foreigners can trade in products such as fertilizers, insemination seeds and pesticides as joint ventures with Myanmar citizens with no minimum share percentage for the local citizens.

Web Resources

International Fertilizer Development Center (IFDC)

International Rice Research Institute (IRRI) Myanmar Pulses, Beans & Sesame Seeds Merchants Association

Myanmar Edible Oil Dealers Association

Myanmar Fruit, Flower and Vegetable Producer and Exporter Association

Myanmar Rice Federation

Contact Information

U.S. Commercial Service Myanmar

Ms. Ummay Aiman

Commercial Specialist

Email: Ummay.Aiman@trade.gov

Prepared by our U.S. Embassies abroad. With its network of 108 offices across the United States and in more than 75 countries, the U.S. Commercial Service of the U.S. Department of Commerce utilizes its global presence and international marketing expertise to help U.S. companies sell their products and services worldwide. Locate the U.S. Commercial Service trade specialist in the U.S. nearest you by visiting http://export.gov/usoffices.