Working Capital Loan ProgramsWorking Capital Loan Programs

Financing offered by commercial lenders on export inventory and foreign accounts receivables is not always sufficient to meet the needs of U.S. exporters. Early-stage small and medium-sized exporters are usually not eligible for commercial financing without a government guarantee. In addition, commercial lenders are generally reluctant to extend credit due to the repayment risk associated with export sales. In such cases, government-guaranteed export working capital (EWC) loans can provide the exporter with the liquidity to accept new business, help grow U.S. export sales, and let U.S. firms compete more effectively in the global marketplace. Two U.S. Government agencies—the U.S. Small Business Administration (SBA) and the U.S. Export-Import Bank (Ex-Im Bank)— offer loan guarantees to participating lenders for making export loans to U.S. businesses. Both agencies focus on export trade financing, with SBA typically handling facilities up to $5 million and Ex-Im Bank processing facilities of all sizes. Through these government-guaranteed EWC loans, U.S. exporters can obtain financing from participating lenders when commercial financing is otherwise not available or when their borrowing needs are greater than the lenders’ credit standards would allow.

Key Points

- The loan expands access to EWC for supplier financing and production costs.

- The loan maximizes the borrowing base by turning export inventory and accounts receivable into cash.

- Risk mitigation may be needed to offer open account terms confidently in the global market.

- SBA’s EWC loan is appropriate for U.S. small-sized businesses and has credit lines up to $5 million.

- Ex-Im Bank’s EWC loan is available for all U.S. businesses, including small and medium-sized exporters, and has credit lines of all sizes.

- Both SBA and Ex-Im Bank generally guarantee 90 percent of the bank’s EWC loan.

CHARACTERISTICS OF A GOVERNMENT‑GUARANTEED EXPORT WORKING CAPITAL LOAN

Applicability

Recommended when commercial financing is otherwise not available or when pre-approved borrowing capacity is not sufficient

Risk

Exposure of exporter to the risk of non-payment without the use of proper risk mitigation measures

Pros.

Encourages lenders to offer financing to exporters.

Enables lenders to offer generous advance rates

Cons.

Cost of obtaining and maintaining a guaranteed facility.

Additional costs associated with risk mitigation measures

Comparison: Commercial Facility vs. Government-Guaranteed Facility

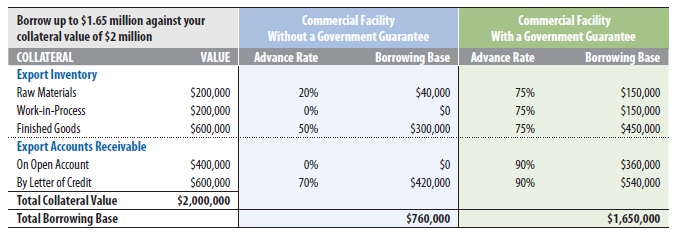

Table 3 is an example of how a government-guaranteed export loan from a lender participating with SBA or ExIm Bank can increase your borrowing base against your total collateral value. Advance rates may vary depending on the quality of the collateral offered.

Table 3: Government-guaranteed loans increase your borrowing power

Key Features of SBA’s Export Working Capital Program

- Exporters and indirect exporters must meet SBA eligibility and size standards.

- There is no application fee and there are no restrictions regarding foreign content or military sales.

- A 0.25 percent upfront facility fee is based on the guaranteed portion of a loan of 12 months or fewer.

- Fees and interest rate charged by the commercial lender are negotiable.

- The “Export Express” program can provide exporters and lenders a streamlined method to obtain SBA-backed financing for EWC loans up to $500,000. With an expedited eligibility review, a response may be obtained in fewer than 36 hours.

- Exporters and indirect exporters are also eligible for the International Trade Loan Program that offers permanent working capital and fixed asset financing for export and related business purposes.

For more information, visit the SBA Web site at www.sba.gov/international and click on the dropdown menu for SBA Export Programs or call 1-800-U-ASK-SBA (8-275-722).

Key Features of Ex-Im Bank’s Export Working Capital Program

- Exporters and indirect exporters must adhere to the Bank’s requirements for content, non-military uses, environmental and economic impact and to the Country Limitation Schedule.

- There is a non-refundable $100 application fee.

- A 1.75 percent upfront facility fee based on the total loan amount and a one-year loan but may be reduced to 1 percent with export credit insurance and if designated requirements are met.

- Fees and interest rate charged by the commercial lender are usually negotiable.

- Enhancements are available for minority- or woman-owned, rural and environmental firms.

- Participating commercial lender partners can expeditiously process EWC loans under established criteria without pre-approval from Ex-Im Bank.

For more information, visit the Ex-Im Bank Web site at www.exim.gov or call 1-800-565-EXIM (3946).

Why Risk Mitigation May Be Needed

Government guarantees on export loans do not make exporters immune to the risk of non-payment by foreign customers. Rather, the government guarantee provides lenders with an incentive to offer financing by reducing the lender’s risk exposure. Exporters may need some form of risk mitigation, such as export credit insurance, to offer open account terms more confidently.

1. SBA encourages the use of American made products, if feasible. Borrowers must comply with all export control requirements Prepared by the International Trade Administration. With its network of 108 offices across the United States and in more than 75 countries, the International Trade Administration of the U.S. Department of Commerce utilizes its global presence and international marketing expertise to help U.S. companies sell their products and services worldwide. Locate the trade specialist in the U.S. nearest you by visiting http://export.gov/usoffices.

Key Points

- The loan expands access to EWC for supplier financing and production costs.

- The loan maximizes the borrowing base by turning export inventory and accounts receivable into cash.

- Risk mitigation may be needed to offer open account terms confidently in the global market.

- SBA’s EWC loan is appropriate for U.S. small-sized businesses and has credit lines up to $5 million.

- Ex-Im Bank’s EWC loan is available for all U.S. businesses, including small and medium-sized exporters, and has credit lines of all sizes.

- Both SBA and Ex-Im Bank generally guarantee 90 percent of the bank’s EWC loan.

CHARACTERISTICS OF A GOVERNMENT‑GUARANTEED EXPORT WORKING CAPITAL LOAN

Applicability

Recommended when commercial financing is otherwise not available or when pre-approved borrowing capacity is not sufficient

Risk

Exposure of exporter to the risk of non-payment without the use of proper risk mitigation measures

Pros.

Encourages lenders to offer financing to exporters.

Enables lenders to offer generous advance rates

Cons.

Cost of obtaining and maintaining a guaranteed facility.

Additional costs associated with risk mitigation measures

Comparison: Commercial Facility vs. Government-Guaranteed Facility

Table 3 is an example of how a government-guaranteed export loan from a lender participating with SBA or ExIm Bank can increase your borrowing base against your total collateral value. Advance rates may vary depending on the quality of the collateral offered.

Table 3: Government-guaranteed loans increase your borrowing power

Key Features of SBA’s Export Working Capital Program

- Exporters and indirect exporters must meet SBA eligibility and size standards.

- There is no application fee and there are no restrictions regarding foreign content or military sales.

- A 0.25 percent upfront facility fee is based on the guaranteed portion of a loan of 12 months or fewer.

- Fees and interest rate charged by the commercial lender are negotiable.

- The “Export Express” program can provide exporters and lenders a streamlined method to obtain SBA-backed financing for EWC loans up to $500,000. With an expedited eligibility review, a response may be obtained in fewer than 36 hours.

- Exporters and indirect exporters are also eligible for the International Trade Loan Program that offers permanent working capital and fixed asset financing for export and related business purposes.

For more information, visit the SBA Web site at www.sba.gov/international and click on the dropdown menu for SBA Export Programs or call 1-800-U-ASK-SBA (8-275-722).

Key Features of Ex-Im Bank’s Export Working Capital Program

- Exporters and indirect exporters must adhere to the Bank’s requirements for content, non-military uses, environmental and economic impact and to the Country Limitation Schedule.

- There is a non-refundable $100 application fee.

- A 1.75 percent upfront facility fee based on the total loan amount and a one-year loan but may be reduced to 1 percent with export credit insurance and if designated requirements are met.

- Fees and interest rate charged by the commercial lender are usually negotiable.

- Enhancements are available for minority- or woman-owned, rural and environmental firms.

- Participating commercial lender partners can expeditiously process EWC loans under established criteria without pre-approval from Ex-Im Bank.

For more information, visit the Ex-Im Bank Web site at www.exim.gov or call 1-800-565-EXIM (3946).

Why Risk Mitigation May Be Needed

Government guarantees on export loans do not make exporters immune to the risk of non-payment by foreign customers. Rather, the government guarantee provides lenders with an incentive to offer financing by reducing the lender’s risk exposure. Exporters may need some form of risk mitigation, such as export credit insurance, to offer open account terms more confidently.

1. SBA encourages the use of American made products, if feasible. Borrowers must comply with all export control requirements Prepared by the International Trade Administration. With its network of 108 offices across the United States and in more than 75 countries, the International Trade Administration of the U.S. Department of Commerce utilizes its global presence and international marketing expertise to help U.S. companies sell their products and services worldwide. Locate the trade specialist in the U.S. nearest you by visiting http://export.gov/usoffices.